THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

For some, this bill can mean the difference between living a comfortable life and living paycheck to paycheck.

Regardless of where you fall, if you lower your mortgage payment you can save more money every month or start saving money in the first place.

But what are the best ways to lower your mortgage payment? Is this even possible?

The answer is yes. You can lower your mortgage payment with a little bit of effort on your part.

And in this post, I am going to share with you 10 overlooked tips to reduce your mortgage payment.

You can choose one of these tips or combine a few to make a huge reduction in the cost of your mortgage.

Let’s get started so you can saving money today!

Table of Contents

10 Overlooked Tips To Lower Your Mortgage Payment

#1. Refinance To A Lower Interest Rate

The most common way to lower your mortgage payment is to refinance your loan. When you refinance to a lower interest rate, you will save money over the long term.

For example, let’s say you have a $225,000 loan at 4% for 30 years. You are paying $1,074 a month for your mortgage.

If you refinance this at a 3.5% interest rate for 30 years, you will be paying $1,010 a month for your mortgage. You just saved $65 a month or $780 a year.

While some of you might not think this is a lot of money, don’t overlook the interest savings. By refinancing the example above, you will save close to $23,000 in interest charges.

Here is a nice calculator to play around with to see how much money you could save by refinancing your mortgage.

Understand that when you refinance, you will have to pay closing costs which impacts your savings. Luckily there are some banks that offer zero closing cost refinances.

#2. Refinance And Lengthen The Loan Term

If you like the idea of refinancing but need to save more money in the short term, you can still refinance. You just have to lengthen the term of your loan.

What does this mean? Let’s use the same scenario above. You have a loan of $225,000 at 4% interest for 30 years. You are 10 years into your mortgage, meaning you have 20 years of payments left.

If you were to refinance your loan at 3.5% for another 30 years, you would be saving $370 a month in the form of a lower mortgage payment.

But there is a catch. When you do this, you will pay more in interest. If you never refinanced, you would pay $161,707 in interest.

By following the example of refinancing and lengthening your loan, you will end up paying $177,849 in interest.

Because of this, I don’t recommend you extend the length of your loan unless money is extremely tight and you have no other option.

But even then, you might have other options you aren’t aware of.

Keep reading to see if any of the other tips can help you lower your mortgage payment more effectively.

#3. Re-Amortize Your Loan

Also known as recasting your loan, this works when you make a large payment on your loan and then your lender re-amortizes your loan.

Everything about your loan stays the same in terms of interest rate and term, but you get a lower monthly payment and end up paying less interest over the life of the loan.

For example, let’s say you took out a $225,000 mortgage at 4% for 30 years. You are paying $1,074 a month. Five years into the loan, you pay a lump sum of $10,000 to your lender and they recast your loan.

Going forward, you still have 25 years left on your mortgage and you are still paying 4% interest. But now your monthly payment is $959 which saves you around $115 a month.

In addition, by recasting your loan, you save close to $6,500 in interest.

Most lenders don’t advertise this option, so be sure to ask. Also, most require at least a $5,000 lump sum payment in order to recast your loan.

Where might this money come from? Inheritances and work bonuses are the most likely options.

#4. Pay Extra Each Month

Did you know if you pay extra each month towards your principal, you can lower your monthly mortgage payment if you have an adjustable rate mortgage?

You’ll even be able to shorten the term of the loan by doing this.

All you need to do is add a little extra to each mortgage payment now. Then in a few years, you will start to see the impact with a lower monthly payment. How great is this?

But what if you have a fixed rate mortgage? While you won’t see a reduced mortgage payment by paying extra, you will shorten the life of the loan.

This means you could pay off your 30 years mortgage in 25 years.

So while you are paying more now, you could save a ton of money in the long run. Let’s take a look at this in action.

Let’s assume you have a $225,000 mortgage for 30 years at a fixed rate of 4%. Just your principal and interest payment comes to $1,074. But what if you put an extra $25 a month towards your principal?

In this case your monthly payment would be $1,099.

What impact does this have on your mortgage? By paying just $25 extra each month, you will pay your mortgage off over 1 year early and save over $8,000 in interest!

And what’s even better, since you are paying off your mortgage early, you get to save the $1,074 monthly payment over 1 year earlier.

In that year you saved yourself almost 13,000! What would you do with an extra $13,000?

And if you can figure out ways to put more money towards your mortgage each month, you will save more in interest, pay off your mortgage even faster, and be able to save the $1,074 even sooner!

A little later in this post, I’ll give you some specific examples of ways to put extra money towards your mortgage every single month.

#5. Pay Bi-Weekly

What if money is tight and you can’t afford to pay extra on your mortgage? Or what if your income fluctuates and you have a tough time paying your mortgage? Say hello to bi-weekly payments.

By going with this option, you split your mortgage payment in half and pay one half on the 15th of the month and the other half at the end of the month.

How does this save you money? There are 52 weeks in a year which means there are 26 weeks when you look at 2 week increments.

By paying your mortgage every 2 weeks, you end up making one extra payment each year. Still confused? Here is how it works.

Assume your mortgage payment is $1,074 a month. Instead of paying this amount on the 30th of the month, you pay $537 on the 15th and the other $537 on the 30th.

When you do this, you make 26 payments of $537, which comes to $13,962. If you were to pay $1,074 once a month, you would make 12 payments which total $12,888.

As you can see, you make 1 extra mortgage payment. This extra payment has a big impact on your overall mortgage.

Using the numbers from the previous example, by making one extra payment a year through bi-weekly payments, you save close to $24,000 in interest and pay off your mortgage close to 4 years faster.

So if you take your monthly mortgage payment for those 4 years and save that money instead, you end up with over $51,000!

Before you run out and start paying bi-weekly, understand how your lender applies payments. Many won’t apply a partial payment to your balance.

This means if you send in $537 on the 15th, your lender will sit on the money and earn themselves interest until they get the other $537 at the end of the month.

To overcome this, simply move the $537 into a separate savings account every two weeks. Then send in the full payment due at the end of the month.

By the end of the year, you will have an extra payment in the savings account that you can send in to be applied to your balance.

Finally, if your lender offers to set up a bi-weekly payment plan, look it over closely. Many charge fees for this benefit and you don’t need to pay for it.

#6. Cancel Private Mortgage Insurance

If you put down less than 20% when buying a home, you are going to be paying private mortgage insurance, or PMI.

This will be added to your monthly mortgage bill every month until your loan balance drops to 80% of the home’s original appraised value.

For example, if your home was appraised at $250,000 and you put down less than 20%, you will be paying PMI.

You will have to keep paying PMI until your loan balance drops to $200,000. At this point, PMI can be cancelled.

But here are a couple of things you need to know about PMI.

- Your lender isn’t required by law to remove PMI until your loan balance drops to 78% or below. In other words, don’t rely on your lender to cancel PMI. You have to call them when your loan reaches 80%.

- You can get PMI canceled sooner if your house appreciates in value. You will have to pay for the new appraisal so any savings might be wiped out right there. But before you go this route, talk to your lender first as some may not accept the new appraisal.

- On the flip side, if housing prices drop, your lender might not cancel PMI when you get to 80%. I had this happen to me. There was a clause in the mortgage that said they can get a new appraisal if housing prices drop.

- Lastly, the canceling of PMI only applies to owner occupied residences. If you bought an investment property or moved out of your primary residence and are now renting it, the lender doesn’t have to cancel PMI when the loan reaches 78%. This is because the loan is now seen as a greater risk of default since you aren’t living there.

At the end of the day, you need to pay attention to your loan balance and get to 80% as fast as you can. Most people pay on average of $125 a month for PMI. This comes to $1,500 a year!

And if you don’t proactively call to cancel PMI when your loan reaches 80%, you are going to be paying this extra $1,500 a year for a few more years when you don’t have to.

#7. Get The Government To Help

Another option to lower your mortgage payment is to seek out government help. There are many programs out there to help homeowners keep their homes.

These services include everything from counseling to refinancing assistance.

And don’t stop at the federal level either. Be sure to check with state and local governments too.

As of this writing, the most popular option is the Home Affordable Refinance Program. This program is in its second version in hopes of helping more homeowners stay in their homes.

#8. Ask Your Lender For Help

Even before you reach out for government assistance, you should call up your lender and explain your situation to them.

Don’t make things up or lie to them. Be honest with what is going on. If you lost your job, tell them this. If you are just struggling to make ends meet, explain this to them.

You may be surprised at how much they are willing to help. At the end of the day, it is less expensive and less of a headache for the bank to foreclose and sell your home than it is for them to work with you to find a solution.

#9. Challenge Your Property Tax Assessment

This is a simple way to lower your mortgage payment but hardly anyone knows about it. Are you paying too much in property taxes? You have no idea, right? Most people don’t.

But a simple search of your neighborhood will tell you.

If your house size and lot are roughly the same as other homes in your neighborhood but you are paying thousands more per month in property taxes, chances are you are overpaying.

What can you do to stop this? You appeal to your county.

If you win, your property taxes get reduced and you lower your mortgage payment because less money needs to go into your escrow account.

This sounds great, but how do you appeal your property tax assessment?

You reach out to a real estate attorney and have them perform an analysis for you. This will determine if it looks as though your assessment is wrong.

They will then represent you in court to try to get your assessment lowered. If they succeed, you pay them a small fee and enjoy lower property taxes.

The process is simple and straightforward and one you need to look into.

#10. Make A Bigger Down Payment

The simplest way to lower your mortgage payment is to take out as small of a loan as possible. While you cannot control housing prices, you can control how much money you put down.

The solution then is to put down as much as you can in the form of your down payment. Obviously putting down 20% will save you roughly $1,500 in PMI costs.

But what if you put more money down? What does this look like?

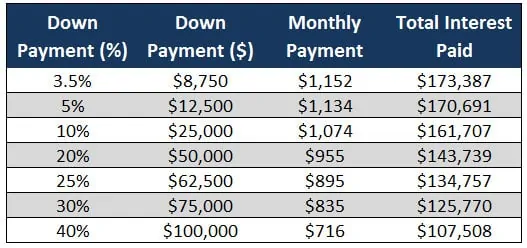

Let’s look at a $250,000 home with a 4% fixed rate mortgage for 30 years. In the table below you will see various down payments, what your monthly payment will be, as well as the total interest you will pay.

Look how much money you can save by putting down 25% or even 40%. You will save yourself thousands of dollars.

And that isn’t the only benefit. Think of it this way. Imagine you buy a house. Things are going well when one day your spouse loses their job.

Suddenly there is financial stress in your life. You have to pay the mortgage and your other bills on one income.

On top of this, your spouse has tremendous pressure to find a job as soon as possible to ease the burden. This doesn’t sound fun does it?

Now imagine this happening but this time you put 30% down. You monthly payment is a lot less than if you put down just 5%.

In fact your monthly payment is $300 less. The stress will still be there but it will be a lot less.

And while your spouse will still be looking for a job, they won’t be in fear of the house going into foreclosure any time soon.

By making a larger down payment, you save money in interest charges and you lower the potential for stress as well.

But you are probably thinking how will you ever save up 30% for a down payment?

Your best option is to increase your income is through side hustles and reducing your expenses.

When it comes to reducing your expenses, try to see where you can easily cut back to save money. Here are a few ideas for you to consider:

- Lower your cable bill. You can easily do this with Trim who will negotiate your bill for you.

- Switch insurers. By shopping around you can get a much lower insurance rate. Here is a great place to get a free quote.

- Determine your values. When you understand what you value, you can cut out a lot of wasted spending.

After you reduce your expenses, take a few minutes to go through your house and find things you don’t use or need. Then sell these items.

You can sell most things on eBay or Craigslist. But to get the most money for your movies, cell phones and video games, look into Decluttr.

They tend to offer the highest payout. You can learn more here.

Finally, you need earn some extra money. How you earn money on the side is up to you and depends on how much you want to work. But I have listed a few favorites below.

- Uber: With no set hours, you are free to drive with Uber before work, after work, or anytime that suits your schedule. You can click here to start the application process.

- Uber Eats: If you like the idea of Uber but don’t want to drive others, look into Uber Eats. Here you deliver food to people. You can click here to start the application process.

- Surveys: Taking surveys is easy and fun. To make the most money, you need to sign up for a couple sites as this will increase the number of surveys available to you. My favorite sites are Springboard America, and Survey Junkie.

- Swagbucks: This is a great site that allows you to earn money in a variety of ways. You can earn money through surveys, watching videos and browsing the internet. But the most money comes when you use Swagbucks to earn cash back for online shopping. New users get $5 when you join for free. Click here to get started.

While it is great to slash your spending and increase your income, you need this money to work for you. This typically would mean putting the money into a savings account to earn interest.

But to grow your money best, you need to figure out how long it is until you will need the money for your down payment.

If you won’t need the money for 5 years or more, I would look into investing your money. You can pick a safe portfolio allocation, like the Conservative portfolio with Wealthsimple and earn more than a typical savings account.

For example, the Conservative portfolio with Wealthsimple earned 9.7% from January 2017 through July 2018. You can click here to start investing with Wealthsimple.

If you will need the money in less than 5 years, then putting your money into a high yield savings account makes the most sense.

I like CIT Bank best because they are always at the top of the list when it comes to highest interest rate paid.

You can click here to get started.

Another option is Worthy. Here you will earn 5% interest on your money. Your money won’t be insured like in a bank account, but the chance of you losing money is very slim.

You can click here to get started with Worthy.

Wrapping Up

So there are 10 overlooked tips to help you lower your mortgage payment. By far the best option is to put as much money down when you buy your house.

This will ensure you get the lowest monthly payment at the start.

But if you already have a mortgage, look into ways of paying extra each month on your loan.

While this won’t help you in the short term with lowering your mortgage payment, it will help you to pay your loan off faster.

And it may even open the door for you to refinance as well, which would lower your mortgage payment by a decent amount.