THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES FOR MORE INFORMATION

Most everyone knows that credit cards can lead to big financial trouble. Buying now with the promise to pay later is a slippery slope that ends in disaster for many.

But did you know you can make money with credit cards?

It’s true and many people earn a decent amount of money every year from using credit cards. And today we are going to show you how you can use credit card tricks to make money.

In total, you will find 11 secret ways to make money with credit cards. The good news is that anyone can use the majority of these secrets.

In fact, I average between $1,000 and $1,500 annually in cash back from credit cards. And here is a great podcast talking about how people travel for free using credit card rewards.

The bad news is that in order to truly make money and not get yourself into debt, you need to have self-discipline.

If you can be smart about your spending, you can ensure that you come out ahead each year and make money by using your credit cards.

Let’s get started looking at the various secret ways to make money with credit cards.

Table of Contents

11 Secret Ways To Make Money With Credit Cards

#1. Use Reward and Cash Back Credit Cards

There are two types of credit cards for you to make money with, rewards cards and cash back cards. Here is a breakdown of each.

- Rewards credit cards: You earn points for each dollar you spend, usually 1 point per dollar spent. When redeeming your points for gift cards or to pay for things, the redemption value is equal to $0.01. So if you want a $100 gift card you would have to redeem 10,000 points.

- Cash back credit cards: You earn cash back for each dollar you spend, usually 1% of the amount spent. Some cards offer higher cash back amounts as well. You can redeem your cash back for statement credits or a check.

I prefer to use cash back credit cards because I find more value in earning cash as opposed to points. You have to decide which type of card is the best fit for you.

If you do choose the cash back card route, try to find cards that offer the highest cash back. I use the American Express Blue Preferred as my main card.

This is because it offers 6% cash back at grocery stores, 3% cash back at gas stations and 1% on everything else. So, when I spend $100 at the grocery store, I earn $6 cash back.

And I make it a point to buy gift cards at the grocery store to take full advantage of the cash back. For example, the other year we needed to replace a television that broke.

We found one at Best Buy we liked, so I headed to my grocery store and bought $500 worth of Best Buy gift cards. Because of this, I earned $30 in cash back.

At the end of the day, you have to decide what your goal is and this will determine the type of credit card you go with.

If you want to travel for free, then rewards cards are a better option. But if you just want cash, then you should stick to cash back credit cards.

#2. Use Your Cards Strategically

I mentioned that I use the American Express Blue Preferred card as my primary card. But I also use other cards. And by using them strategically, I earn the most cash back possible.

The two other cards I use are the Discover It Card and the Citi Double Cash Back Card.

The Discover card offers 5% cash back on rotating categories throughout the year and the Citi card offers 2% cash back on everything.

Here is how I strategically plan to make money using credit cards during the year:

- American Express Blue Preferred: Groceries and gas

- Discover It: Gas, warehouse clubs, and Amazon, when the 5% bonus is active

- Citi Double Cash Back: Everything else.

By using this strategy, I regularly earn between $1,000 and $1,500 in cash back every year.

At first, it was a little confusing to remember which card to use where and when, but now that I have been doing it for a few years, remembering which card to use happens automatically.

#3. Earn Grocery Store Bonuses

Another way you can make money using credit cards is with grocery store bonuses. Does you grocery store offer discounts on gas or groceries when you reach certain spending limits?

For our primary store, if we spend a certain amount during a pre-determined time, we earn $0.10 off every gallon of gas.

For our other store, if we buy a certain amount of gift cards during a promotional period, we earn a $10 coupon good for our next shopping trip.

In both cases, we make sure to monitor these bonus periods and take advantage of them.

If we are close to the end of the period and have not reached the bonus, we will buy a couple gift cards to stores we shop at to hit the goal.

So not only do we make money in terms of credit card cash back, but we also save money by getting discounts or coupons on gas and grocery purchases.

#4. Take Advantage Of Huge Sign On Bonuses

This trick is more for rewards credit cards, but you can get deals sometimes with cash back cards too.

With rewards cards, you might see an offer for 60,000 points when you spend $5,000 a month during the first 3 months you have the card.

If you can achieve this level of spending, you can easily earn some serious credit card rewards.

And you can rinse and repeat this process over and over again.

Many credit card companies limit these deals to new card holders but define a new cardholder as someone who has not had a credit card with the company for at least one year.

So you will have to keep notes on when you closed accounts and when you can re-apply as a new cardholder.

Finally the only other catch here is your credit. In order to take advantage of the best sign on bonuses, you need to have a great credit score.

But as long as you pay your bills on time and don’t get yourself into mountains of debt, you should be able to qualify for these bonuses.

If you don’t know what your credit score is, here is how you can get your credit score for free.

Here is a great resource that is constantly updated with the best credit card sign up bonuses.

#5. Shop Online More Often

Did you know if you shop online with a cash back credit card, you can double dip and earn even more cash back?

Here is how this works. Before you buy anything online, first visit Ebates and Swagbucks. They are online cash back sites that pay you to shop.

If you want to buy something at Best Buy, you can visit Ebates and see you can earn 1% cash back on your purchase.

All you do is click the “shop now” button on Ebates and you are directed to the Best Buy website to make your purchase.

If you spend $100 and earn 1% cash back through Ebates and your credit card, you just earned $2 in cash back versus just $1 by not using Ebates.

What is the catch you ask? There is no catch. Ebates and Swagbucks earn money by having you shop through their website. In other words, Ebates might earn 10% cash back from Best Buy when you make a purchase. They then pass along a percent of this to you.

Why do I recommend both Ebates and Swagbucks? They each offer different cash back amounts and stores. By using both, you ensure you earn the most cash back possible.

You can click here to join Swagbucks. New users to Swagbucks get $5 when you join for free.

Click here to join Ebates. New members to Ebates earn a $10 gift card when joining.

Both are 100% free to use.

#6. Use Credit Card Site Portals

While using online cash back sites to earn more cash back, don’t overlook the online portals of the credit card companies themselves. Many times they offer even better cash back terms.

For a while I was earning 5% cash back on the Discover Deals site for certain stores.

The nice thing here is the stores the credit card portals offer don’t change much, so once you know what they offer, you won’t have to check back on a regular basis.

You can also sign up for email alerts too, letting you know when any bonus cash back events are happening or when new stores are added.

#7. Invest Your Cash Back And Rewards

While it is great to make money with credit cards, you can easily make more money with your cash back when you are smart.

What do I mean with this? Many cash back cards simply offer a statement credit as the redemption option.

On the surface, this is great. You get your bill for $1,000 and you only have to pay $900 because you cash in your accumulated cash back.

But if you are smart, you take your $100 savings and invest it. By doing this, you allow your cash back to compound over time and grow into even more money.

Here is how this works. If your credit card bill is $1,000 and you have $100 in cash back available, you redeem it as a statement credit.

You pay $900 to cover your bill, then transfer $100 from your checking account into an investment account.

How much of an impact can this have? Let’s say you average $500 in cash back per year and you invest it in an account with Wealthsimple that earns an average 8% a year.

After 20 years, you have close to $25,000! What will you do with this extra $25,000?

#8. Use Acorns To Invest Automatically

While the above tip is great, it does involve some work on your end and it also requires you to be disciplined to actually invest the money.

If only there was an easier way.

There is! It is called Acorns.

With Acorns, you open a free account and link your credit card and bank account. When you spend money using your credit card, Acorns will round up your purchase to the nearest dollar.

When your round ups total $5 or more, they will invest the money for you in your Acorns account.

How awesome is this?

And if you are really disciplined, you can combine the last tip and this one to really make money with credit cards.

Simply take the cash back you earn and make lump sum deposits into your Acorns account.

Before you know it, you will have a nice little nest egg all thanks to using credit cards.

Click here to get started with Acorns. New users get $5 when you open an account.

#9. Take Advantage Of 0% Offers

There are some cards that offer you a 0% interest rate when you sign up for the card. To make money in this case, you need to be disciplined.

Simply begin spending on the card and when the balance comes due, only pay the minimum. Then take the remainder of the balance due and put that money into a savings account.

Continue doing this every month until you reach the end of the promotional 0% interest rate offer.

Then use the money in your savings account to pay off the entire balance on your credit card.

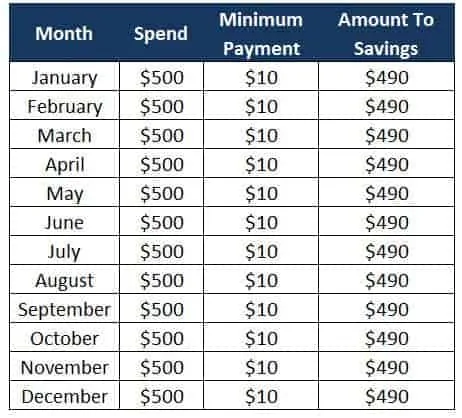

For example, let’s say you spend $500 on your credit card a month. You take the minimum payment amount, $10 and pay your bill. Then you take the other $490 and put it into a savings account.

Here is how this looks each month:

You made money in two ways. First, as you were spending money, you were ideally earning cash back or rewards. If you earned just 1% on all of your purchases, you made $60.

Second, you were earning interest on the balance in your savings account. If you were earning 1% on your savings balance, you earned $30.

In total, you made $90 by using your credit card.

Want to earn the most interest? Read the next tip to see how you can easily earn 5% interest!

#10. Take Advantage Of 0% Balance Transfer Offers

This secret way to make money with credit cards is also know as credit card arbitrage. If you are disciplined, you can make good money doing this.

But if you aren’t disciplined, then you can get yourself into trouble fast.

How does credit card arbitrage work? The simplest explanation is that you take out 0% balance transfer offers, save the money in an account that earns interest, and slowly pay it back.

Simple right?

Here is how it would work out in real life.

#1. You get an offer from one of your credit cards for a 0% offer. Instead of having the credit card company pay off some other debt for you and carry your balance on the balance transfer card, you request a check and cash it in.

#2. You deposit the money into a high yielding savings account or other safe savings product. My favorite is Worthy, where you can earn 5% on your money.

#3. As the month’s pass by, you pay the minimum on your credit card using the money in your savings account. Bonus points if you just pay the minimum from your income and leave the money in the savings account alone.

#4. The month before your balance transfer special interest rate expires, you withdraw the remainder of the money in the savings account to pay off the debt.

#5. You keep the difference, which is the interest you earned.

#6. Rinse and repeat.

It really is this simple. But let’s give you some real life numbers to drive home this point. Let’s say you take advantage of a 0% balance transfer offer for 24 months and request $5,000.

You take the $5,000 and deposit it into your Worthy account earning 5% interest.

Each month for the next 23 months, you pay the minimum on your credit card. To keep things simple, we will say it is $75.

You take the money from your checking account and leave the money in your Worthy account alone.

When the bill comes for your next credit card payment, you pay off the balance using the money in your Worthy account.

How much money did you make? You earned $500 in interest. You just made money using credit cards!

If you want to open an account with Worthy, click here.

#11. Sell Your Rewards

The final tip to make money with credit cards is to sell your rewards. Well, not exactly sell your rewards, but use them to make money.

For example, let’s say you can use your credit card rewards for seats at an upcoming popular concert. You have no interest in going, but your friend does.

If tickets cost $150 a seat and they want 2 seats, you offer to use your points to get yourself two “free” tickets. Then you turn around and sell the tickets to your friend for $250.

They save money by doing this and you make money doing this.

Now, before you run out and start advertising your plans to sell your credit card rewards, know that most credit card companies forbid this.

If they catch you, they will have you forfeit all your points.

But if you do this on a small scale with just friends and family, the credit card company will not catch on. In other words, just be smart about it.

Wrapping Up

At the end of the day, you can easily make money with credit cards. You just need to create a plan, stick with it and be disciplined.

If you can do this, you are going to earn cash back easily. Look at me as an example. Without much work at all, I average between $1,000 and $1,500 cash back every single year.

And I make it a point to invest the cash back so it grows into larger amounts. ‘

Using the example in the point about investing your cash back, by investing my $1,250 average cash back every year, I’ll have over $61,000 to do as a please in 20 years.

If I wasn’t using cash back cards, I wouldn’t have anything to show for it.

The bottom line is if you use credit cards, make sure you are using cash back or rewards cards so you can make money when you spend money.

The process is simple and the benefits are great.

This is also possible in the UK. Another way people in the UK make money from credit cards is they take out ones with an introductory interest free period (typically for 12+ months) and then put up to the limit in a high interest savings account which under UK law is guaranteed to be protected. Therefore they could borrow at 0% and potentially earn 2.5%-3% from savings. May not seem like a lot but on £10,000 it’s £300, and before the recession when savings rates were much higher the potential rewards were obviously much greater.

Great idea, Bristolboy – thanks for chiming in! Don’t think that will work in the US beings I think all credit cards here charge a cash advance fee that would negate the potential interest earnings. And I think the amount of cash you can get is also restricted to well below the card’s credit limit. But for folks in the UK, that is certainly another way to make money with your credit card.